|

|

LOCAL INCENTIVES

Like you, we aim to out-perform the competition. Low regulations, low cost of labor, excellent local colleges and universities, and a customized approach to incentives facilitates our growing economy. Here is a sample of tools we possess to give your business a head start in Clarksville including, but not limited to:

CLARKSVILLE'S SITE ALLOCATION PROGRAM (CSAP)

- Businesses in targeted industries may be eligible for a low-to-no cost lease-to-own parcels on industrial and commercial city-owned property. At the City's discretion, targeted businesses may also receive municipal aid for land preparation or infrastructure development. Visit our Site Selection Page to discover available commercial properties in Clarksville.

RAPID RESPONSE WORKFORCE TRAINING & RECRUITMENT (In Development)

- Reimbursable training expenses for instructor wages, curriculum development, and materials for new or expanding businesses. The city can also assist in the hiring process by targeting skill-specific labor for recruitment by offering the service of a third party recruiting consultant.

UTILITY COSTS

- Working alongside our municipally-owned utilities, cost-savings are identified and rates may be adjusted for targeted industries locating to Clarksville.

TAX ABATEMENT

- At the municipal and county level, select businesses may be eligible for tax abatements, or incremental tax cuts for the first few years of operation. This incentive is largely contingent on base minimum wage and payroll figures.

As a standard practice, we will conduct cost benefit analysis on all proposals over $100,000 to provide customized and actionable support to prospecting companies. With data in hand, we will target your greatest need and fill that gap with an incentive package that ensures short and long-term success for your business.

STATE INCENTIVES

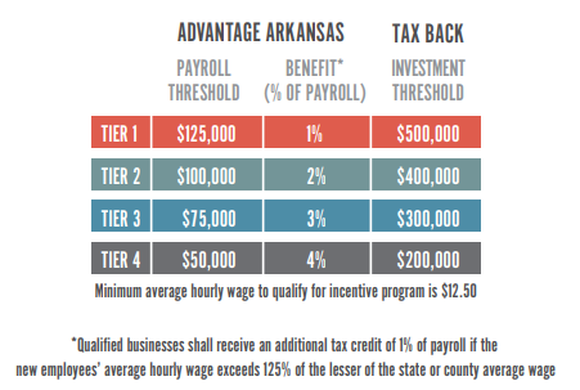

INCENTIVE TIERS

- Arkansas' job-creation incentives are based on payroll and use a tier system based on poverty rate, unemployment rate, per capita personal income and population growth to determine qualification criteria and benefits. Tiers are assigned annually based on current data. Clarksville is designated as a TIER 3 City.

ADVANTAGE ARKANSAS (INCOME TAX CREDIT)

- Advantage Arkansas offers a state income tax credit for job creation based on the payroll of new, full-time, permanent employees hired as a result of the project. The Tier Map linked above shows the job creation requirements and the benefits of the program.

- In order to qualify for the Advantage Arkansas program (all tiers), the proposed average hourly wage of the new employees hired as a result of the project must be equal to or greater than $12.50.

- The Advantage Arkansas income tax credit is earned each tax year for a period of five years. The income tax credit cannot offset more than 50% of a business’ income tax liability in any one year and may be carried forward for nine years beyond the tax year in which the credit was first earned. The credit begins in the tax year in which the new employees are hired. Employees included in the new additional payroll under the project must be Arkansas taxpayers.

ARKPLUS (INCOME TAX CREDIT)

- ArkPlus is a state income tax credit program that provides tax credits of 10% of the total investment in a new location or expansion project. This incentive is offered at the discretion of the AEDC Executive Director.

- ArkPlus requires both a minimum investment and a minimum payroll of new, full-time, permanent employees hired as a result of the project, depending on the tier in which the business locates. The business must reach the investment threshold for the tier in which it is located within four years from the date of the signing of the financial incentive agreement and the payroll threshold for the tier in which it is located within 24 months from the date of the signing of the financial incentive agreement.

- The income tax credits may be used to offset 50% of the Arkansas income tax liability in the tax year the credit is earned. Any unused credits may be carried forward for nine years beyond the tax year in which the credit was first earned.

TAX BACK PROGRAM (SALES & USE TAX REFUND)

a) sign a job creation agreement under the Advantage Arkansas or Create Rebate programs within 24 months of signing the Tax Back agreement or;

b) have signed an Advantage Arkansas or Create Rebate agreement within the previous 48 months.

- The Tax Back program provides sales and use tax refunds on the purchase of building materials and taxable machinery and equipment to qualified businesses investing the minimum required based on the tier in which the company locates and who either;

a) sign a job creation agreement under the Advantage Arkansas or Create Rebate programs within 24 months of signing the Tax Back agreement or;

b) have signed an Advantage Arkansas or Create Rebate agreement within the previous 48 months.

- Applicants for Tax Back must also obtain an endorsement resolution from a local governing authority authorizing the refund of its local taxes. Applicants must meet the qualification criteria under the requisite Advantage Arkansas or Create Rebate program in which they are participating and must be approved by AEDC.

- The refund of sales and use taxes shall not include the refund of state taxes dedicated to the Educational Adequacy Fund provided in §19-5-1227 or the state taxes dedicated to the Conservation Tax Fund provided in §19-6-484; which totals 1%. The state tax rate is 6.5%, therefore the eligible refund amount is 5.5%.

Contact us directly if you would like to further explore our ability to support you.

[email protected]

C: 518-775-8712

C: 518-775-8712